Know Your Customer

General

What does KYC mean? KYC stands for "Know Your Customer" and is part of the Money Laundering Act. KYC is used by companies subject to the Money Laundering Act. Companies must get to know their customers to avoid everything from money laundering to companies not doing business with criminals. It is a requirement for Ayvens that we as a company can document that we know our customers. This includes, among other things, control of identity and financial activities, but also to be able to identify the risk posed by individual customers.What is the Money Laundering Act? The Money Laundering Act is about reducing financial crime and money laundering. The Money Laundering Act, also known as the Preventive Measures Against Money Laundering and Terrorist Financing Act, is legislation designed to combat money laundering and terrorist financing.Customer identification and verification

As a sole proprietorship, what should I provide as means of identification? In connection with our KYC process (customer identification and verification of you as a customer), you as a sole trader or the beneficial owner of the company must inform us of the following: - Full name - Address - Date of birth This is a company that becomes a customer of another company. What information do we need? - The company's legal name - The company's legal form - Registration number - Address - Information about the beneficial owner of the company What documentation do we need? - Organizational chart with ownership structure and shareholdings, signed and dated - Ultimate Beneficial Owner (UBO) of the customer - Certificate of Registration - Customer due diligence form signed with BankID/Identification formOwnership

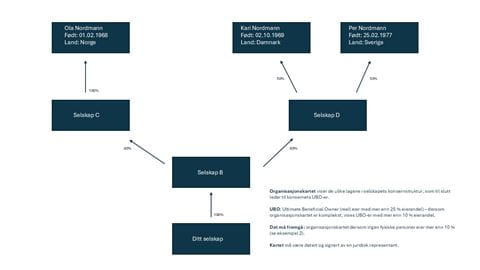

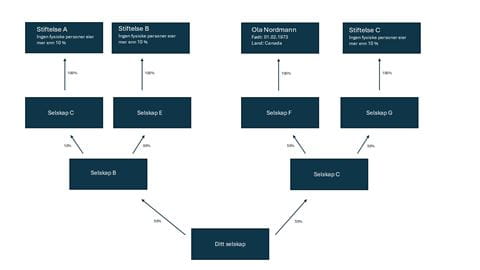

What`s a beneficial owner? A beneficial owner is the person or persons who own or control the business.How do I identify who the owner(s) is/are? A beneficial owner is a natural person who directly or indirectly owns or controls more than 25% of the company. If the company is owned by another company, the same rule applies. Beneficial owners will always be one or more physical human beings. This rule must be followed up through the ownership structure of the natural person(s) who owns more than 25% of the top company in the organization. (If you have a complex group diagram, however, it is down to an ownership stake of 10%)What if there is no natural person who owns more than 25% of the company? If there is no natural person who owns or controls more than 25% of the company, the managing director or board of directors of the company that owns the company is considered the beneficial owner.Ownership information

What owner information do we need from you? Once the person or persons who own or control the business have been identified, the following information must be obtained: - Name - Residence - Date of birth How do you process and store my information? All information provided to Ayvens is of course processed in accordance with applicable GDPR legislation, which you can read more about on our website [here.](targetSelf:/en-no/privacy-statement-ayvens/)Do all customers have to answer your questions about money laundering and PEP? It depends on several different factors. If this becomes relevant, you will be notified through SignantWhat does PEP mean? Politically Exposed Persons (PEPs) are persons who contest a special public office of trust and, as a result, may be susceptible to bribery and other corruption.Signant

What is Signant? I’ve received a link? Signant is a company whose products handle workflows in connection with digital contracts, digital signatures, and compliance with the Money Laundering Act. We use them so that we can securely collect documents from our customers. [Here’s](targetSelf:/en-no/signant/) how to fill out the Signant form.Identification

If there are rights holders who cannot use Bank ID, a separate identification form can be used. Download here.